The Easiest Way to Collect

Customer Reviews on Google

How to conduct an internal financial audit in a company? - business guide

Table of contents

Financial audit is an extremely important element of every company. Thanks to it, you can accurately check the state of finances and the risks associated with the company's activities. In this business guide, we will discuss how to conduct an internal financial audit in a company and what types of audits, procedures, and standards are associated with this field.

Why is business audit important? How to check it

Financial audit is a process that allows for a thorough examination of the financial condition of a given entity, e.g. a company. It is essential for both managers and investors who make decisions based on financial statements. Auditing also helps identify irregularities and improvements in the management system, which translates into better company results.

Types of financial audits (external audit, internal operational audit, compliance)

There are many types of audits, each with its specific objectives and scope. Here are some of the most important:

-

Internal audit: This is an activity carried out by an internal auditor, aimed at providing an independent assessment of an organization, its risk management effectiveness, and improving the company's operations. Internal audit is an independent activity.

-

External audit: Carried out by an independent certified public accountant, it is required for public companies and aims to provide an independent assessment of financial statements.

-

Operational audit: Focuses on evaluating the operational efficiency of a company and identifying areas requiring corrective action. It also serves an advisory role.

-

Compliance audit: Focuses on ensuring the company's compliance with legal regulations and industry standards.

What does the process of conducting a financial audit of a company look like?

1. Choosing an auditor

The first step in conducting a financial audit is to choose the appropriate auditor. This can be an individual or a company with the necessary experience and certifications to conduct an audit in accordance with ISO standards.

2. Audit planning

Next, we proceed to audit planning. We determine the objectives, scope, procedures, and schedule for conducting the audit. It is important to ensure a comprehensive assessment of the company's finances.

3. Conducting the audit

The auditor thoroughly examines the documentation and financial reporting, reports, accounting procedures, and other relevant documents. They identify any inconsistencies and irregularities.

4. Reporting and recommendations

After completing the audit, the auditor prepares a report that includes the audit results, identified issues, and recommendations for improvements. This stage is crucial because based on the report, we can learn about the strengths and weaknesses of our company and make strategic decisions.

Compliance with ISO standards

It is worth noting that many companies strive to obtain ISO compliance certification. This is particularly important, especially if the company operates in the public sector or is listed on the stock exchange. Financial audit is often an integral part of this process as it helps assess whether the company meets ISO requirements.

How to contact a financial auditor?

If you need to conduct an internal financial audit in your company, it is important to find the right expert. You can use the services of independent experts in the field of financial auditing. It is also worth consulting legal and auditing firms that have experience in the industry.

Summary of the role of audit

Internal financial audit is a key element of risk management and improving company operations. Through a thorough assessment of the financial condition and compliance with ISO standards, a company can achieve its goals and grow. Remember that financial audit is an independent and objective process aimed at providing a clear picture of the financial situation of the company.

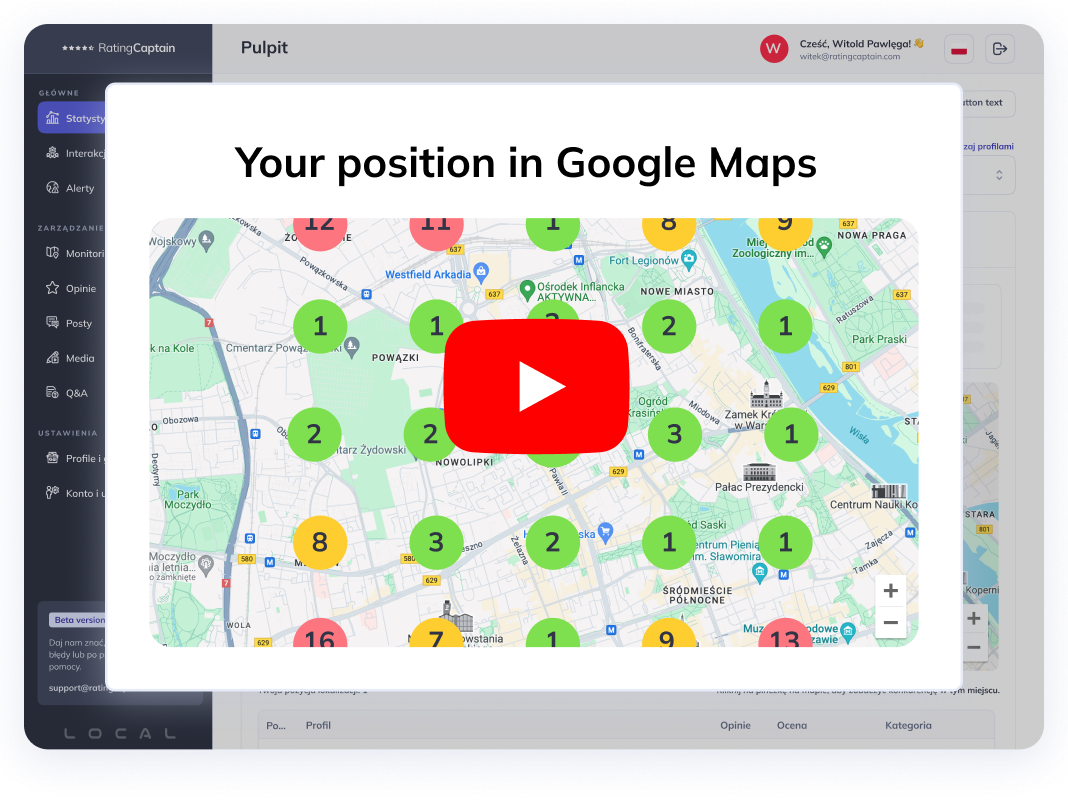

Rating Captain

If you need an application for collecting and managing reviews, the Rating Captain application can help. It is an effective tool that supports businesses in obtaining and managing reviews. In the Rating Captain application, sending even hundreds of invitations will take less than 10 minutes.

Thanks to this application, customers will be able to easily and conveniently share their experiences with the quality of your services when purchasing a product or service, allowing your company to gain greater awareness among customers on the Internet.

Please rate this article

Local SEO tool

for agencies

Automate your local SEO

and track Google Maps visibility